Financial professionals come with many titles, and the differences between them aren’t obvious. Someone calling themself a “financial advisor” may hold any number of certifications or licenses, or none at all. Here is a brief overview of the main players.

Registered Representative of a Broker-Dealer, or “Broker”

A registered representative of a broker-dealer, or “broker,” works for a brokerage firm and sells securities, bonds, life insurance, mutual funds, and other financial products. Brokers have passed one or more examinations, such as a Series 6 exam conducted by the Financial Industry Regulatory Authority (FINRA), but they aren’t regulated by the Securities and Exchange Commission (SEC) like some other financial professionals. And they might not have the same level of training as some other advisors.

Brokers also have an incentive to sell their firm’s in-house financial products and high-commission products, because they will earn more this way. Moreover, brokers are not required to be fiduciaries. Rather, they are held to the “suitability” standard under FINRA Rule 2111, meaning they sell the investor products that are “suitable” for him or her, but not necessarily in the investor’s best interest.

As of June 2020, brokers are held to a higher standard called the “best interest” standard under Regulation B.I. But it remains to be seen if Regulation B.I. really changes broker’s conduct or the standard of care that they owe you.

Brokers are employed by a large broker dealer such as Morgan Stanley or a smaller, independent broker dealer such as Ameriprise. But not all broker dealers are the same. Capitalization requirements for brokerage firms are as little as $5,000.

Registered representatives might also call themselves “financial advisor.” Under Regulation B.I., they can only do this if they are registered as both a broker (with FINRA) and as a Registered Investment Advisor (with the SEC).

Registered Investment Advisor (RIA)

Registered Investment Advisors (RIAs) are regulated by the Securities and Exchange Commission (SEC). RIAs offer investment advice and manage their clients’ investment accounts. And they have a fiduciary duty to their clients, which means recommending advice and products that are in your best interest.

RIAs usually work independently, unlike brokers, who work for brokerage firms. Also unlike brokers, RIAs don’t have in-house financial products to sell you. But in some cases, they still earn commissions from selling mutual funds. In other cases, an RIA might be fee-only. Fee-only RIAs are a growing and popular choice for investors because it tries to eliminate the conflict of interest that comes with selling hich-commission products.

Certified Financial Planner (CFP)

A Certified Financial Planner (CFP) is someone who has knowledge in several areas of finance, including investments, insurance, estate planning, and taxes. Like RIAs, CFPs are fiduciaries who must offer you advice based on what is in your best interest. CFPs have three or more years of financial planning experience, have passed thorough examination, and have continuing education requirements.

Vetting your financial professional

Regardless of their title, you should check if your financial advisor has any disciplinary history. You can do this on FINRA’s BrokerCheck site for Registered Representatives of broker-dealers.

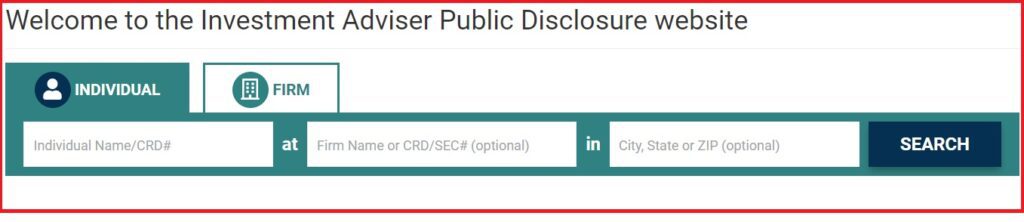

For Registered Investment Advisors, you can check their background on the SEC’s Public Disclosure site.

You also should ask if they are a fiduciary. Fiduciaries are required to put your interest first. Financial professionals operating under the “suitability” standard need only make suitable recommendations for you. In practice, a suitable investment can mean offering you a financial product that earns them higher commissions when lower-commission alternatives exist.

Ask them how they are compensated. If they are receiving commissions, that money comes out of your pocket. You are the only one bringing money to the transaction, so any commissions come out of what you pay. You should know how you are compensating your financial advisor.

Ask if they have a fiduciary duty to you

If you are looking for a financial professional, do your research. Understand the distinctions between the titles, and ask if your advisor has a fiduciary duty to you. Contact Wilkowski Law for a free legal assessment if you believe your financial advisor has treated you unfairly.